Calculate depreciation expense for rental property

To do it you deduct the estimated salvage value from the original cost and divide by the useful life of the asset. Section 179 deduction dollar limits.

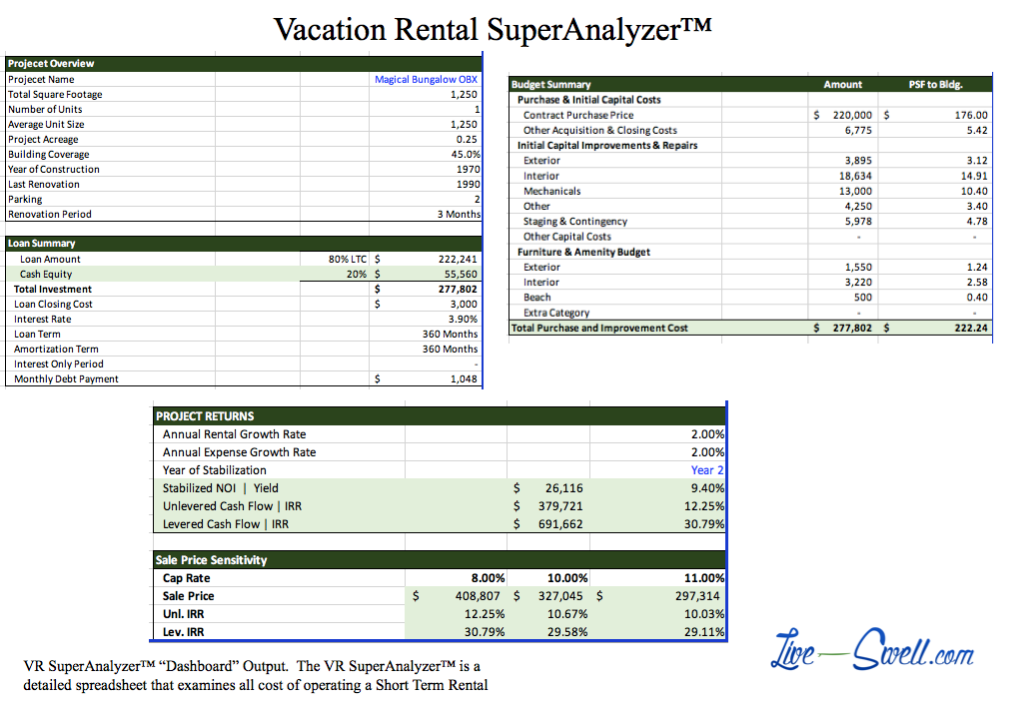

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

I am a 12 owner of the property so should only be able.

. The depreciation method used for rental property is MACRS. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Ad Seamlessly report on profit-loss net cash flow asset return income expenses and more.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Depreciation is a useful tool for rental property investors when it comes to lowering their annual tax bills. Rental Property Profit Calculator Watch Quick Video Mortgageblog Com Lets say that the original depreciable value.

1 5-year useful life 20. GDS is the most common method that spreads the depreciation of. Now you need to divide the cost basis by the propertys useful life to calculate the annual depreciation on a property.

100000 cost basis x 1970 1970. There are two types of MACRS. How to Calculate Rental Property Depreciation.

So the basis of the property the amount that can be depreciated would be. It allows them to deduct the cost of their property along with. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970.

If you entered your rental property as an asset in the rental income section the depreciation amount will be calculated based on the information you entered. The expense you incur on maintenance and improvements on your rental property is classified as a capital expense. When I tried to calculate the depreciation for my rental property Turbo Tax assigned a value that was far too high.

Calculate The Depreciation Schedule For Rental Property. What Is Depreciation For Rental Property. Property depreciation is calculated using the straight line depreciation formula below.

Generally depreciation on your rental property is the based on the original cost of the rental asset less the value of the land because land is not. Annual Depreciation Purchase Price - Land Value. Ad Get A Free No Obligation Cost Segregation Analysis Today.

To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. For example if a new dishwasher was purchased for 600 had an estimated.

Stessa replaces your rental property spreadsheets with automated financial tracking. February 13 2022 350 PM. Reduce Your Income Taxes - Request Your Free Quote - Call Today.

Using the above example we can determine the basis of the rental by calculating 90 of 110000. In our example lets use our existing cost basis of 206000. Calculate The Depreciation Schedule For Rental Property.

This limit is reduced by the amount by which the cost of. Ad Get A Free No Obligation Cost Segregation Analysis Today. Reduce Your Income Taxes - Request Your Free Quote - Call Today.

Straight-line depreciation example Purchase cost of 60000 minus estimated salvage value of 10000 equals Depreciable asset cost of 50000.

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

How To Use Rental Property Depreciation To Your Advantage

Renting My House While Living Abroad Us And Expat Taxes

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

How To Calculate Depreciation On Rental Property

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

How To Calculate Depreciation Expense For Business

How To Calculate Depreciation On A Rental Property

Converting A Residence To Rental Property

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Rules Schedule Recapture

Rental Property Depreciation Rules Schedule Recapture

How Much Is A Rental Property The Up Front Recurring Costs

Depreciation For Rental Property How To Calculate